October 2025 Used Car Market Report: Canadian Pricing and Inventory Analysis

October 2025 Used Car Market Report: Canadian Pricing and Inventory Analysis

Canada's used car market showed notable shifts in October 2025, with 193,893 new listings entering the market and average prices declining 3.3% month-over-month to $46,018. This comprehensive report analyzes pricing trends, regional variations, fuel type dynamics, and inventory patterns across Canada's automotive marketplace.

Based on data from Cardog's analysis of nearly 200,000 active vehicle listings, this report provides actionable insights for buyers, sellers, and industry stakeholders navigating Canada's evolving used car landscape.

Executive Summary

Key Findings:

- National Average Price: $46,018 in October 2025 (down 3.3% from September's $47,583)

- Total October Listings: 193,893 new active listings (16% increase from September's 167,126)

- Average Odometer: 43,905 km (up 13.5% from September's 38,700 km)

- Price Range: $1,000 to $13.2 million

- Market Leaders: Ford F-150 (6,859 listings), Nissan Rogue (4,710), GMC Sierra 1500 (3,971)

The October market reflects a shift toward value-oriented inventory, with increased supply and lower average transaction prices compared to September. Buyers gained leverage as dealers expanded offerings heading into the traditional Q4 slowdown.

National Market Overview

Pricing Trends

October marked a significant correction in used car pricing across Canada:

| Metric | October 2025 | September 2025 | Change |

|---|---|---|---|

| Average Price | $46,018 | $47,583 | -3.3% |

| Average Odometer | 43,905 km | 38,700 km | +13.5% |

| Total Listings | 193,893 | 167,126 | +16.0% |

| Median Price (est.) | ~$38,000 | ~$40,000 | -5.0% |

Analysis: The 3.3% month-over-month price decline represents the largest single-month drop since spring 2025, driven by increased inventory volumes and aging average stock. Higher mileage vehicles entering the market pushed average odometer readings up 13.5%, indicating dealers are trading deeper into their used inventory to maintain sales velocity.

Market Composition

By Body Style

| Body Style | Listings | Avg Price | Market Share |

|---|---|---|---|

| SUV | 106,786 | $43,589 | 55.1% |

| Pickup Truck | 33,959 | $67,459 | 17.5% |

| Sedan | 23,220 | $30,323 | 12.0% |

| Hatchback | 9,282 | $26,644 | 4.8% |

| Other | 8,330 | $44,521 | 4.3% |

| Minivan | 4,049 | $40,278 | 2.1% |

| Coupe | 2,444 | $76,746 | 1.3% |

| Van | 2,293 | $55,573 | 1.2% |

| Wagon | 2,013 | $29,958 | 1.0% |

| Convertible | 1,197 | $84,157 | 0.6% |

| Motorcycle | 191 | $15,698 | 0.1% |

Key Insights:

- SUVs dominate with 55% market share, averaging $43,589

- Pickup trucks command premium pricing at $67,459 average

- Sedans and hatchbacks remain most affordable at under $31,000 average

- Luxury segments (coupes, convertibles) maintain elevated pricing above $76,000

By Fuel Type

| Fuel Type | Listings | Avg Price | Market Share |

|---|---|---|---|

| Gasoline | 148,430 | $42,393 | 76.6% |

| Hybrid | 21,892 | $55,150 | 11.3% |

| Diesel | 7,771 | $90,042 | 4.0% |

| Electric | 6,336 | $57,374 | 3.3% |

| Unknown | 9,464 | $38,001 | 4.9% |

Analysis:

- Gasoline vehicles retain majority market share at 76.6% with most competitive pricing

- Hybrid premiums persist at $55,150 average (+30% vs gasoline)

- Diesel trucks drive diesel category to $90,042 average (heavily skewed by commercial vehicles)

- Electric vehicles average $57,374, representing 3.3% of market

Electric vehicle inventory continues to grow but faces depreciation challenges, with many 2021-2022 EVs now priced 40-50% below original MSRP.

Provincial Market Breakdown

Regional Pricing Analysis

| Province | Listings | Avg Price | Avg Odometer | Market Share |

|---|---|---|---|---|

| Ontario | 83,415 | $45,023 | 43,400 km | 43.0% |

| Quebec | 31,523 | $47,376 | 37,323 km | 16.3% |

| Alberta | 28,028 | $50,681 | 48,571 km | 14.5% |

| British Columbia | 23,158 | $47,057 | 43,957 km | 11.9% |

| Nova Scotia | 8,733 | $37,351 | 57,497 km | 4.5% |

| Manitoba | 5,001 | $43,603 | 43,646 km | 2.6% |

| Saskatchewan | 4,791 | $46,126 | 59,538 km | 2.5% |

| New Brunswick | 4,012 | $40,133 | 45,493 km | 2.1% |

| Newfoundland | 3,874 | $46,714 | 23,069 km | 2.0% |

| PEI | 719 | $41,345 | 29,659 km | 0.4% |

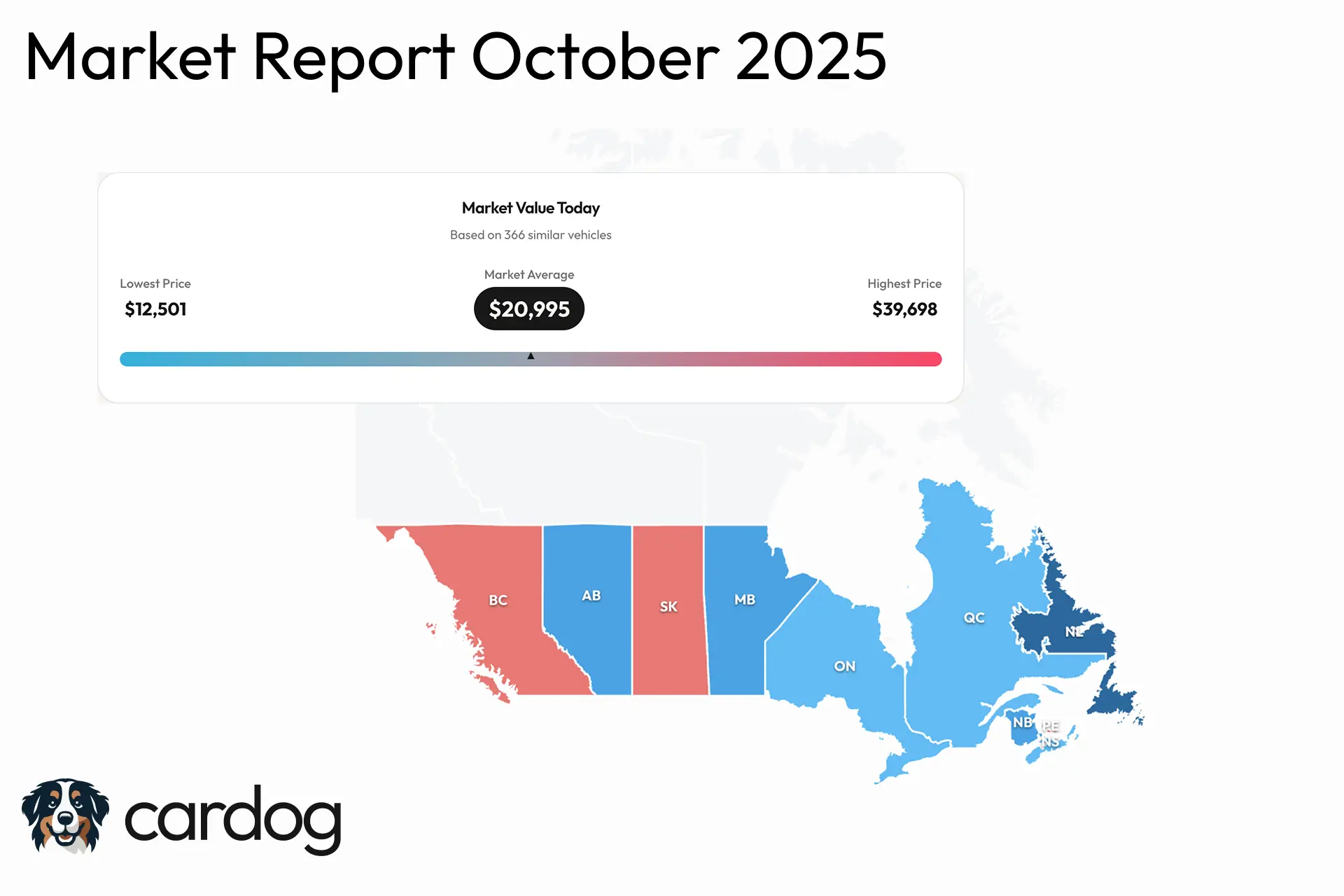

Average pricing by province compared to national average

Regional Insights

Ontario leads with 83,415 listings (43% national market share), pricing slightly below national average at $45,023. The province's mature dealer network and high population density create competitive pricing dynamics.

Alberta commands highest average prices at $50,681, driven by strong pickup truck demand in energy sector markets. However, vehicles also carry highest average mileage (48,571 km), reflecting longer driving distances in rural areas.

Quebec shows lower mileage averages (37,323 km) but elevated pricing ($47,376), likely reflecting urban concentration in Montreal/Quebec City and provincial language requirements creating regional market barriers.

Nova Scotia presents best value at $37,351 average (-19% vs national), though vehicles carry significantly higher mileage (57,497 km). Atlantic Canada generally offers lower entry prices but older fleet ages.

British Columbia maintains near-national average pricing ($47,057) despite geographic isolation, supported by strong import market from Asia-Pacific and high EV adoption rates.

Top 20 Models by Inventory Volume

| Rank | Make | Model | Listings | Avg Price |

|---|---|---|---|---|

| 1 | Ford | F-150 | 6,859 | $64,579 |

| 2 | Nissan | Rogue | 4,710 | $32,079 |

| 3 | GMC | Sierra 1500 | 3,971 | $72,499 |

| 4 | Honda | CR-V | 3,830 | $33,177 |

| 5 | Ford | Escape | 3,579 | $30,790 |

| 6 | Chevrolet | Silverado 1500 | 3,547 | $61,161 |

| 7 | Nissan | Kicks | 3,091 | $28,047 |

| 8 | RAM | 1500 | 2,978 | $74,606 |

| 9 | Honda | CR-V Hybrid | 2,970 | $49,703 |

| 10 | Mazda | CX-5 | 2,935 | $34,172 |

| 11 | Hyundai | Tucson | 2,710 | $31,392 |

| 12 | Volkswagen | Tiguan | 2,657 | $35,417 |

| 13 | Toyota | RAV4 | 2,570 | $34,272 |

| 14 | Hyundai | Elantra | 2,460 | $22,982 |

| 15 | Ford | Bronco Sport | 2,107 | $38,970 |

| 16 | Kia | Seltos | 2,000 | $30,385 |

| 17 | Chevrolet | Trax | 1,910 | $28,710 |

| 18 | Jeep | Wrangler | 1,903 | $55,026 |

| 19 | Hyundai | Kona | 1,902 | $29,451 |

| 20 | Honda | Civic | 1,875 | $25,293 |

Model Analysis

Pickup Trucks Dominate Premium Segment: Full-size trucks (F-150, Sierra, Silverado, RAM 1500) represent 4 of top 8 models by volume, averaging $68,211. Canadian preference for pickups remains strong despite elevated pricing.

Compact SUV Wars: The 10,000-14,000 km range sees intense competition between Rogue, CR-V, Escape, and Mazda CX-5, all priced $30,790-$34,172. This represents the market's sweet spot for family buyers.

Hybrid Honda Premium: CR-V Hybrid averages $49,703 vs standard CR-V at $33,177—a 50% premium for electrification. Despite higher entry price, hybrid inventory moves quickly due to fuel economy advantages.

Value Leaders: Hyundai Elantra ($22,982) and Honda Civic ($25,293) offer most accessible transportation, though inventory remains constrained compared to SUV segments.

Wrangler Holds Value: Jeep Wrangler maintains $55,026 average despite ranking #18 in volume, demonstrating strong residual values in enthusiast segments.

Affordability Analysis

Price Distribution

| Price Range | Listings | Percentage | Segment |

|---|---|---|---|

| Under $15,000 | 18,542 | 9.6% | Budget/Entry |

| $15,000-$25,000 | 31,425 | 16.2% | Economy |

| $25,000-$35,000 | 44,673 | 23.0% | Mass Market |

| $35,000-$50,000 | 52,817 | 27.2% | Mid-Market |

| $50,000-$75,000 | 32,284 | 16.6% | Premium |

| $75,000-$100,000 | 9,847 | 5.1% | Luxury |

| $100,000+ | 4,305 | 2.2% | Ultra-Luxury |

Affordability Insights:

- 49% of market priced under $35,000, providing access for budget-conscious buyers

- Mass market segment ($25k-$35k) represents largest share at 23%, centered on compact SUVs and sedans

- 27% of inventory falls in $35k-$50k range, dominated by mid-size SUVs and trucks

- 7.3% exceeds $75,000, consisting primarily of luxury vehicles and new-generation pickups

Best Value Segments

Under $25,000 Opportunities:

- Hyundai Elantra: Average $22,982

- Honda Civic: Average $25,293

- Nissan Kicks: Average $28,047

- Chevrolet Trax: Average $28,710

$25,000-$35,000 Sweet Spot:

- Ford Escape: Average $30,790

- Kia Seltos: Average $30,385

- Hyundai Tucson: Average $31,392

- Nissan Rogue: Average $32,079

Market Outlook

Q4 2025 Expectations

Price Pressures: Seasonal Q4 slowdown typically drives 2-4% additional price reductions November-December as dealers clear aged inventory. October's 3.3% decline suggests this process began early in 2025.

Inventory Build: 16% month-over-month listing growth indicates dealers are rebuilding stock after lean summer months. Increased supply should continue favoring buyers through year-end.

Interest Rate Sensitivity: Bank of Canada's policy trajectory will critically impact financing costs and buyer affordability. Each 25bp rate change affects monthly payments by approximately $15-20 per $10,000 financed.

EV Market Evolution: Electric vehicle pricing remains in flux as 2022-2023 models face steep depreciation. Opportunity for buyers willing to navigate charging infrastructure; risk for sellers holding aging EV inventory.

Strategic Recommendations

For Buyers:

- Timing: October-December offers optimal pricing power; avoid spring market when demand rebounds

- Negotiation leverage: 16% inventory growth provides strong bargaining position

- Geographic arbitrage: Consider purchasing from Nova Scotia/New Brunswick (19% below national average) if willing to travel

- Body style trade-offs: Sedans and hatchbacks offer 39% savings vs SUVs with similar utility for many buyers

For Sellers:

- Act quickly: Declining prices and rising inventory favor immediate listing over waiting

- Competitive pricing essential: Average days-on-market likely extending; price aggressively to stand out

- Geographic targeting: Alberta and BC markets support 10%+ price premiums over Atlantic Canada

- Highlight fuel efficiency: Hybrid and efficient gasoline models commanding premiums in current market

How Cardog Provides Market Intelligence

Understanding these market dynamics is valuable, but applying them to your specific situation requires personalized analysis. Cardog's AI-powered platform analyzes real-time data across 900,000+ active listings to help you identify whether a specific vehicle is priced fairly, track how long similar vehicles stay on market, and compare pricing across different regions.

Whether you're buying a Honda CR-V in Ontario or selling a Ford F-150 in Alberta, Cardog provides instant market context showing how your vehicle compares to thousands of similar listings. The platform tracks price changes, identifies which dealers offer best value, and alerts you to new inventory matching your criteria.

Explore the market on Cardog to see how current listings in your area compare to national trends.