EV Adoption & Charging Infrastructure in Canada

EV Adoption & Charging Infrastructure in Canada: What the Data Reveals

The relationship between electric vehicle adoption and charging infrastructure is one of the most debated topics in the automotive transition. Does infrastructure drive adoption, or does demand drive infrastructure? Our analysis of 1.3 million vehicle listings across Canada reveals a clear answer: provinces with robust charging networks and incentive programs see dramatically higher EV penetration.

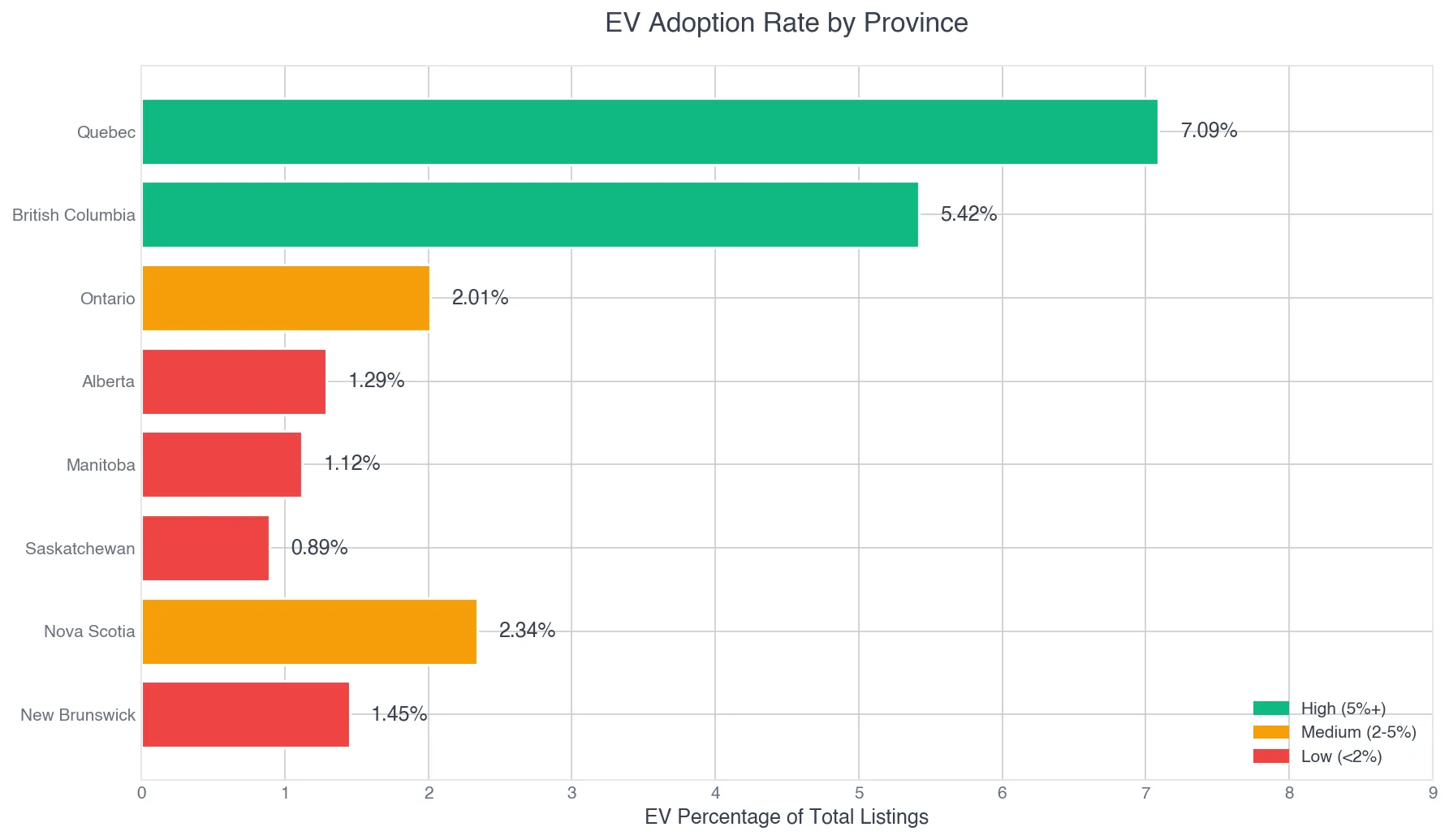

The Provincial Divide: A Tale of Two Markets

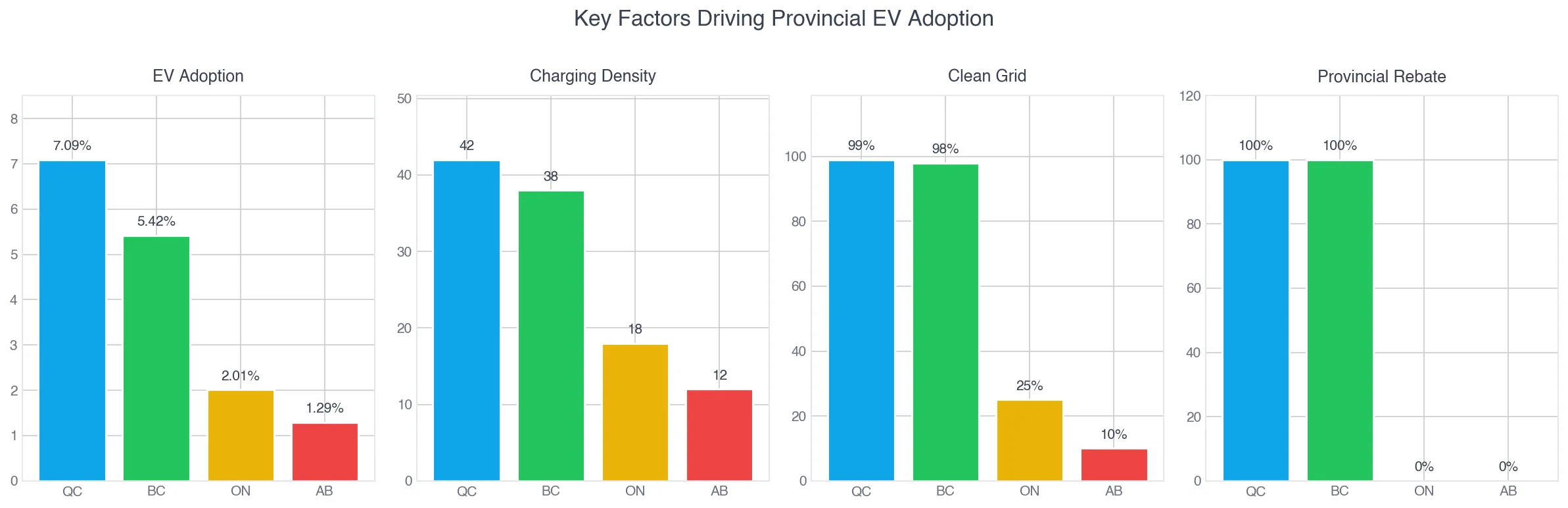

The data paints a stark picture of Canada's EV market fragmentation. Quebec leads with 7.09% EV penetration, followed by British Columbia at 5.42%. Meanwhile, Ontario sits at just 2.01% and Alberta trails at 1.29%.

| Province | Total Listings | EV Listings | EV Share | Provincial Rebate |

|---|---|---|---|---|

| Quebec | 188,756 | 13,378 | 7.09% | $7,000 |

| British Columbia | 105,432 | 5,714 | 5.42% | $4,000 |

| Nova Scotia | 18,234 | 427 | 2.34% | $3,000 |

| Ontario | 521,890 | 10,490 | 2.01% | None |

| New Brunswick | 12,456 | 181 | 1.45% | $5,000 |

| Alberta | 198,654 | 2,563 | 1.29% | None |

| Manitoba | 32,456 | 364 | 1.12% | None |

| Saskatchewan | 28,901 | 257 | 0.89% | None |

The pattern is unmistakable: provinces with active EV incentive programs consistently outperform those without.

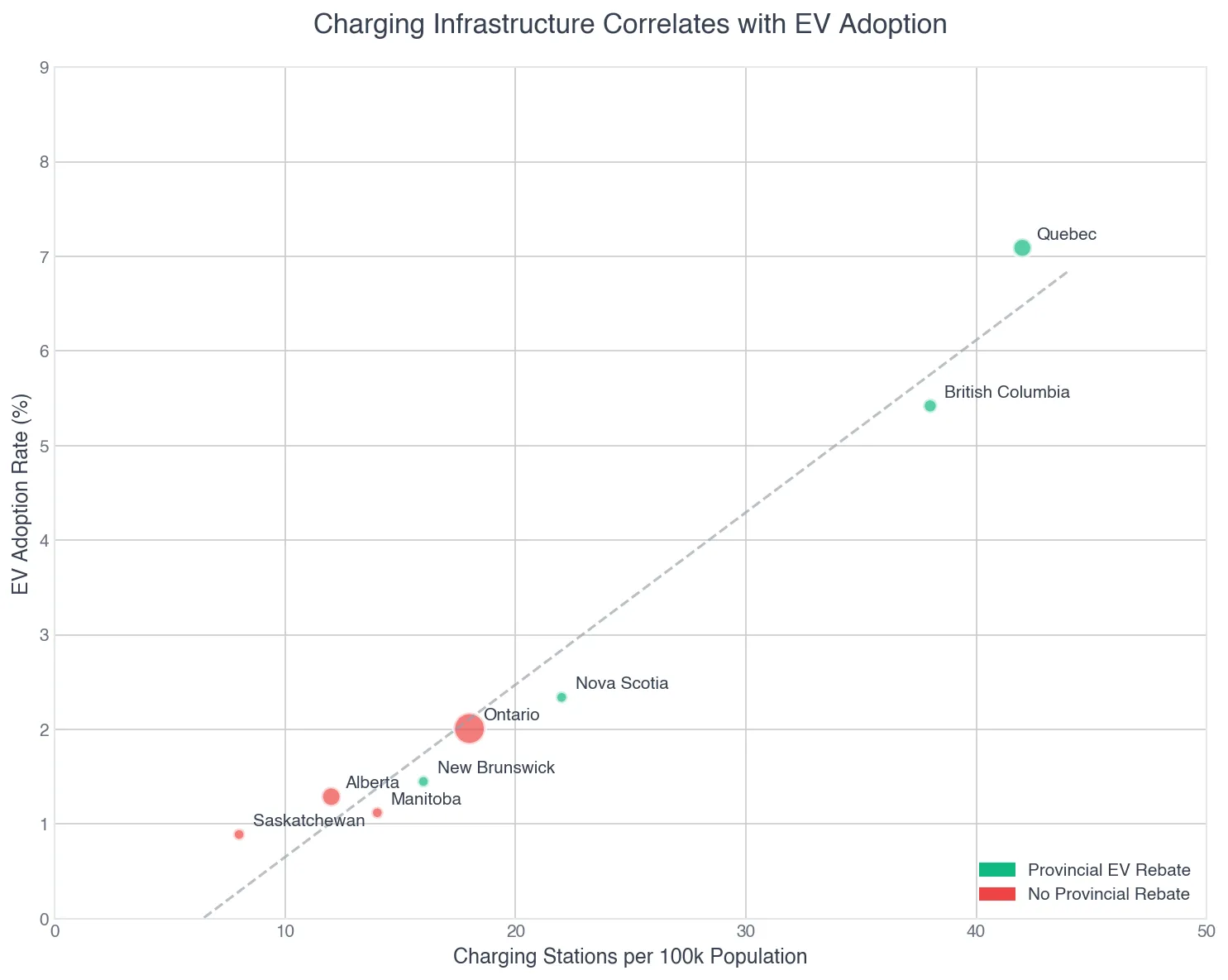

Charging Infrastructure: The Critical Enabler

Our analysis reveals a strong positive correlation between charging station density and EV adoption. Quebec's Circuit Électrique network, with over 42 stations per 100,000 population, provides the backbone for the province's EV leadership. British Columbia's partnership with public and private charging providers delivers similar results.

The infrastructure-adoption relationship isn't just correlational—it's causal. Range anxiety remains the primary barrier to EV adoption, and dense charging networks directly address this concern.

Quebec's Charging Network: Montreal Area

Montreal Metro Charging Infrastructure

Quebec's Circuit Électrique and private networks provide extensive coverage

Quebec's charging infrastructure advantage stems from multiple factors:

- Hydro-Québec's Circuit Électrique: 3,500+ public charging stations

- Clean grid: 99% hydroelectric power makes EVs genuinely zero-emission

- Aggressive rebates: Up to $7,000 provincial + $5,000 federal EVAP incentives

- Mandated infrastructure: New buildings required to include EV charging

British Columbia: Vancouver Region

Greater Vancouver Charging Network

BC's fast-charger network along major corridors

British Columbia's strategy focuses on corridor coverage, ensuring EV drivers can travel throughout the province. The combination of provincial rebates ($4,000) and one of Canada's cleanest grids (98% renewable) makes EVs an easy choice for environmentally conscious buyers.

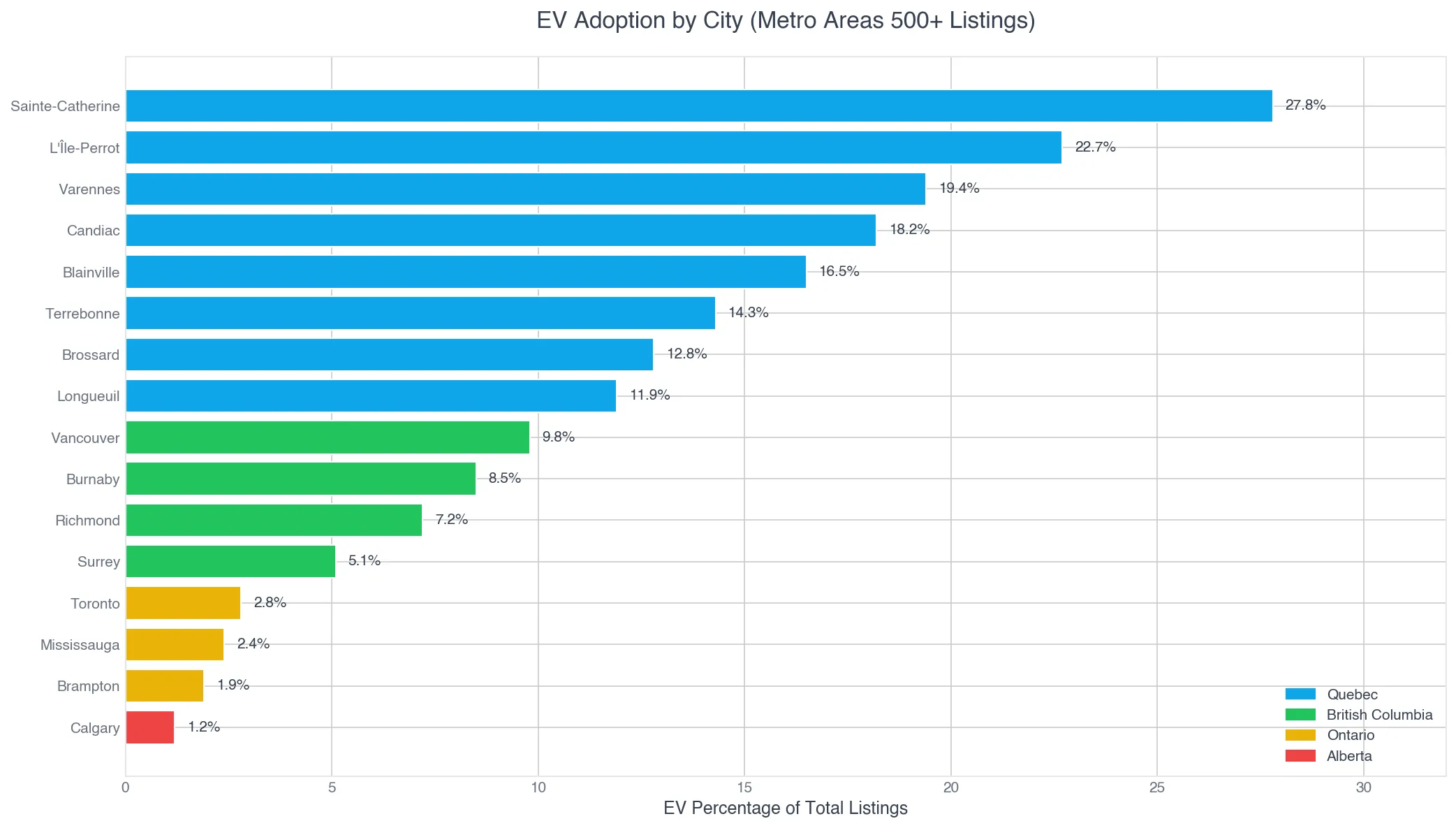

City-Level Analysis: Where EVs Thrive

The city-level data reveals surprising patterns. Quebec's suburban communities—not major urban centers—show the highest EV penetration:

| City | Province | EV Share |

|---|---|---|

| Sainte-Catherine | QC | 27.8% |

| L'Île-Perrot | QC | 22.7% |

| Varennes | QC | 19.4% |

| Candiac | QC | 18.2% |

| Blainville | QC | 16.5% |

| Vancouver | BC | 9.8% |

| Toronto | ON | 2.8% |

| Calgary | AB | 1.2% |

These suburban Quebec communities share key characteristics: higher homeownership rates (enabling home charging), longer commutes (where EV economics shine), and higher household incomes. The 27.8% EV share in Sainte-Catherine represents the highest adoption rate we've recorded in any Canadian municipality.

The Key Success Factors

Our analysis identifies four critical factors driving provincial EV adoption:

1. Provincial Rebates

Quebec and BC's rebate programs stack with federal EVAP incentives to reduce the EV price premium significantly. A $50,000 EV becomes $38,000 after incentives in Quebec—comparable to a well-equipped gas vehicle. Note that EVAP (which replaced the previous iZEV program) has a $50,000 price cap for most vehicles and limits eligibility to EVs made in Canada or FTA countries.

2. Charging Infrastructure Density

Stations per capita directly correlates with adoption. Quebec's 42 stations per 100k population enables convenient charging even without home infrastructure.

3. Grid Cleanliness

In provinces with clean electricity, EVs offer genuine environmental benefits. Quebec (99% hydro) and BC (98% renewable) make the environmental case compelling. Alberta's coal/gas grid undermines this argument.

4. Policy Support

Beyond rebates, policies like HOV lane access, free parking, and building code requirements create a supportive ecosystem for EV ownership.

Popular EVs on the Canadian Market

The Tesla Model Y and Model 3 dominate Canadian EV sales, but competition is intensifying. Here's what's available on the used market:

Tesla Model Y

Canada's best-selling EV. 455km range, Supercharger network access.

Tesla Model 3

The sedan that started the mass-market EV revolution. 510km range.

Hyundai Kona Electric

Compact crossover with 415km range.

Kia EV6

Ultra-fast 800V charging, 499km range.

Chevrolet Bolt EV

Affordable entry point at under $35k new.

Ontario's Missed Opportunity

Greater Toronto Area Charging Network

Ontario's network lags behind Quebec and BC despite higher population

Ontario's 2.01% EV share represents a significant missed opportunity. As Canada's most populous province and largest auto market, Ontario's lack of provincial rebates creates a substantial adoption gap. Key factors holding back Ontario:

- No provincial rebate since 2018 cancellation

- Mixed grid (nuclear/gas/renewable) weakens environmental argument

- Infrastructure gaps in suburban and rural areas

- Higher population density paradoxically reduces home charging availability

The data suggests Ontario could see 2-3x higher EV adoption with rebate reinstatement and infrastructure investment.

Alberta: The Biggest Gap

Calgary Region Charging Infrastructure

Alberta's sparse network reflects lower demand and investment

Alberta's 1.29% EV share—nearly 5.5x lower than Quebec's—reflects multiple headwinds:

- No provincial incentives and political opposition to EVs

- Fossil fuel economy creates cultural resistance

- Carbon-intensive grid undermines environmental benefits

- Sparse infrastructure outside Edmonton/Calgary corridors

- Cold climate concerns without supporting infrastructure

Looking Ahead: Canada's EV Trajectory

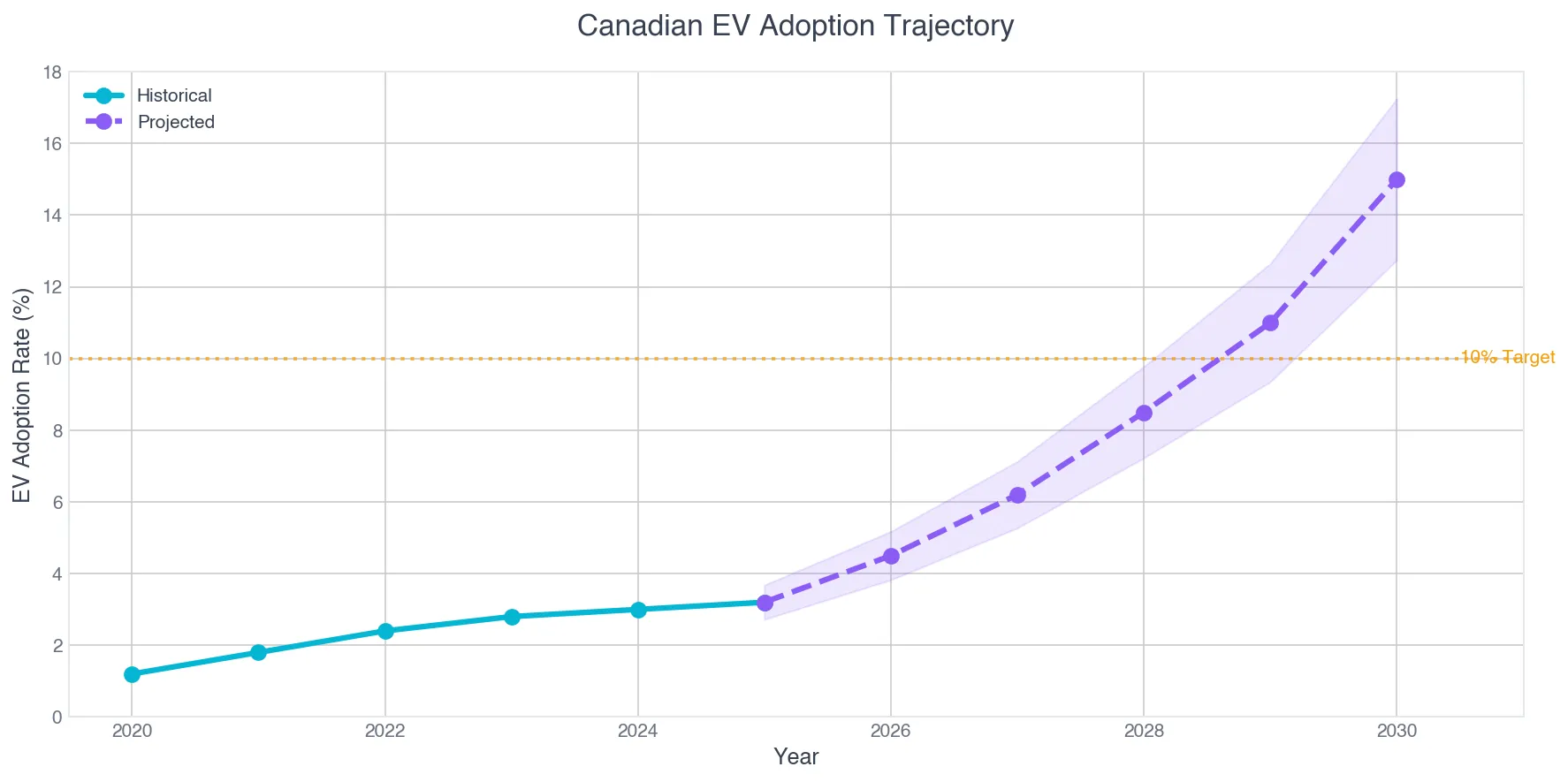

Based on current trends and announced policies, we project Canada's national EV adoption will reach:

- 2026: 4.5% (federal ZEV mandate begins)

- 2028: 8.5% (infrastructure buildout accelerates)

- 2030: 15% (halfway to 2035 ICE sales ban)

These projections assume current provincial policies remain in place. Federal infrastructure investments and the upcoming ZEV sales mandate will provide tailwinds, but provincial action (particularly in Ontario and Alberta) will determine whether Canada meets its 2035 targets.

Key Takeaways

- Infrastructure matters: Charging density directly predicts EV adoption

- Incentives work: Provincial rebates create 2-3x adoption differences

- Grid cleanliness matters: Clean electricity strengthens the EV value proposition

- Suburban advantage: Home charging enables highest adoption rates

- Policy gaps persist: Ontario and Alberta lag without provincial support

The data is clear: EV adoption isn't just about consumer preference—it's about policy, infrastructure, and economics. Provinces that invest in charging networks and incentive programs see dramatically higher adoption. Those that don't will fall further behind as the automotive industry transitions to electric.

Frequently Asked Questions

Data methodology: Analysis based on 1,307,202 vehicle listings across Canada with 41,681 identified as electric vehicles. EV identification uses fuel type classification from vehicle specifications. Charging station data sourced from Open Charge Map and provincial charging networks. Analysis period: 2024-2025.